Shopify Payments Alternatives: Best Payment Gateways for You

- October 7, 2025

- Payment gateway

Estimated reading time: 18 minutes

Ah, the world of e-commerce! It’s a vast ocean, isn’t it? And if you’re sailing a Shopify store, you’ve likely encountered Shopify Payments, the platform’s native solution. It’s robust, convenient, and often the first port of call for many merchants. But what happens when the waters get a bit choppy? Perhaps Shopify Payments isn’t quite the right fit for your unique voyage, or maybe its geographical limitations are casting a shadow over your global aspirations. Fear not, intrepid entrepreneur! The good news is that the digital realm offers a treasure trove of alternatives. Shopify, ever the accommodating host, integrates with over 100 payment processors worldwide, each ready to facilitate smooth transactions between you and your cherished customers.

As seasoned navigators of the e-commerce landscape, we understand that finding the perfect payment gateway is more than just picking a name off a list. It’s about optimizing your operations, safeguarding your revenue, and ultimately, enhancing your customers’ journey. Our In-Depth Guide: How to Start a Shopify Store Successfully! In this comprehensive guide, we’ll delve into some of the most prominent and effective Shopify Payments alternatives, updated with the latest insights for 2025, to help you chart a course to seamless transactions. So, unfurl your sails, and let’s explore!

Key Takeaways:

- Selecting a payment gateway impacts your international reach, profitability, and checkout experience.

- There are over 100 Shopify-compatible payment processors; key options include PayPal, Stripe, Verifone, Authorize.net, and more.

- Fees and features differ, so assessing your business’s specific needs is vital.

- Security, support, refunds, and analytics are important features to prioritize.

- Offering multiple gateways can boost conversion and customer satisfaction.

Table of Contents

- Decoding Your Choice: How to Select the Ideal Payment Gateway

- A Deep Dive into Premier Shopify Payment Alternatives

- Your Burning Questions Answered: Shopify Payments FAQs

- Taking the Next Step: Empowering Your E-commerce Journey

- Concluding Thoughts: Charting Your Course to Seamless Transactions

Decoding Your Choice: How to Select the Ideal Payment Gateway

Choosing a payment gateway is akin to selecting the right compass for your expedition – it guides your financial transactions and impacts your business’s trajectory. Before you commit to any one solution, it’s prudent to weigh several critical factors. Think of these as your navigational stars, helping you find an alternative perfectly aligned with your business’s ethos and operational needs.

Understanding Your Business Blueprint

Every business has its own unique character and aspirations. Shopify vs. Amazon: Which Platform Is Better for Your Business? Consider where your products will find their market, whether it’s primarily local shores or international waters, spanning thousands of kilometers or just a few miles. This geographical scope directly influences which currencies you’ll need to accept and, consequently, which gateways can support your ambition. Do you foresee a future where your artisanal crafts are purchased in euros, yen, or perhaps even a less common currency? Your chosen gateway must readily embrace this global outlook.

The Allure of Fair Fees

Let’s be candid: everyone appreciates a good value. When evaluating payment gateways, a discerning eye towards transaction fees is paramount. While some providers might appear similar at first glance, even minor percentage differences can accumulate significantly as your sales volume expands. A gateway offering competitive rates allows you to retain a larger portion of your hard-earned profits, making your venture more sustainable and rewarding. Remember, the goal isn’t just to make sales, but to make profitable ones!

Fortifying Against Fraud

In the digital marketplace, security isn’t merely a feature; it’s a fundamental necessity. A robust payment gateway acts as your digital sentinel, equipped with advanced fraud detection capabilities to protect both your business and your customers. Losing revenue to fraudulent transactions or dealing with the repercussions of chargebacks can be a significant setback. Prioritizing providers known for their rigorous security protocols, such as sophisticated algorithms and robust encryption, provides an invaluable shield against unwelcome intrusions.

Effortless Refunds and Insights

The journey of commerce doesn’t always flow in a straight line; sometimes, returns and refunds are an unavoidable part of the landscape. An efficient refund process is a mark of superior customer service and operational maturity. Look for a gateway that simplifies these settlements, making them convenient for you and transparent for your customers. Furthermore, the ability to tap into real-time analytics offers a strategic advantage. These insights, acting like a ship’s log, provide a clear view of your business’s performance, allowing you to identify trends, optimize strategies, and steer towards greater efficiency. A gateway with a consistently high transaction success rate, ensuring fewer lost sales, is another beacon of reliability.

A Deep Dive into Premier Shopify Payment Alternatives

Ready to discover the perfect co-pilot for your Shopify store’s financial operations? Let’s embark on a detailed exploration of the leading payment gateways that offer compelling alternatives to Shopify Payments.

| Payment Gateway | Transaction Fees (Online) | Special Features | Global Reach & Currencies |

|---|---|---|---|

| PayPal | 3.49% + $0.49 (Standard), 2.59% + $0.49 (Online Card) | Easy setup, high fraud prevention, transaction records | 200+ locations, 25 currencies |

| Stripe | 2.9% + $0.30 | Universal card acceptance, transparent pricing, real-time insights | 135+ currencies, 47+ countries |

| Verifone | 3.5% + $0.35 | Global expansion, subscription tools, detailed reporting | 45+ countries, 100+ currencies |

| Elavon | £32/£45 monthly (350 transactions) + £0.12/additional | Cost-effective for UK/EU, user-friendly, 24/7 support | Primarily European (UK, Ireland) |

| Authorize.net | 2.9% + $0.30 (+$25 monthly gateway fee) | Advanced Fraud Detection Suite (AFDS), customizable API, multi-channel support | US, Canada, UK, Australia, parts of Europe, 11 currencies |

| Braintree | 1.9% + £0.20 (UK), +1% non-UK | Multi-currency support, no long-term contracts, PCI-DSS Level 1 | 47 countries, 135+ currencies |

| FasterPay | 2.7% + $0.30 (US/Canada), 2.7% + €0.30 (Europe), 3.9% + $0.30 (RoW) (+$9.99 monthly) | High-level security (PCI DSS Level 1), 24/7 support, customizable features | 16+ currencies, global presence |

| Amazon Pay | 2.9% + $0.30 (Domestic), 3.9% + $0.30 (Cross-border) | Quick integrations, leverages Amazon customer base, one-click checkout | 18 nations, 12+ currencies |

| Fondy.io | 0.5% + £0.20 (UK), 0.5% + €0.25 (EU) | Easy CMS/CRM integration, multi-currency transactions, smooth payouts | 200+ countries, 150+ currencies (payouts in EU) |

| Square | 2.6% + $0.10 (Card-present), 2.9% + $0.30 (Online) | All-in-one POS, user-friendly interface, no hidden fees | 8+ countries, supports various card payments |

1. PayPal: The Ubiquitous Digital Wallet

PayPal remains a titan in the payment processing arena, a household name recognized by millions globally. As a third-party payment stalwart, it serves a diverse clientele, from fledgling small-to-medium enterprises to independent freelancers and everyday consumers. Its expansive network supports transactions in over 200 geographical locations and handles more than 25 currencies, making it a truly universal option. While business-related money transfers incur a processing fee, sending funds between friends and family typically remains free. Many merchants report a notable uplift in conversion rates, sometimes as high as 28%, simply by offering PayPal as a checkout option – a testament to its trusted status.

Why Merchants Embrace PayPal:

- Widespread adoption and strong customer trust.

- Setup is quick and straightforward.

- Robust fraud prevention and buyer/seller protection.

- Encrypted transactions and comprehensive financial records.

- E-check management, payment follow-up, and streamlined refunds.

Navigating Potential Hurdles with PayPal:

Merchants occasionally encounter abrupt account freezes if their automated algorithms flag any activity as unusual or suspicious. This can be disruptive, so clear communication and diligence are essential.

Financial Aspects of PayPal:

Generally no monthly fees. Standard transaction fee for online payments is 3.49% + $0.49, with a slightly lower rate for card processing (2.59% + $0.49). Always check PayPal’s business pricing for your region.

2. Stripe: The Developer’s Darling and Global Powerhouse

Stripe often operates quietly behind the scenes, yet it powers countless e-commerce operations, including Shopify Payments itself. Renowned for flexibility, Stripe allows businesses to accept major credit cards and many e-wallets, supporting over 135 currencies. For countries lacking Shopify Payments, Stripe often steps in as a prime alternative. Its reliability has even earned the trust of giants like Amazon Shopify vs. Amazon and Booking.com.

The Undeniable Advantages of Stripe:

- Universal card and currency acceptance.

- Transparent fee structure with no hidden costs.

- Real-time data, analytics, and excellent reliability.

Limitations:

Stripe accounts are only available to approximately 47 countries, with further expansion expected.

Stripe’s Pricing Model:

No monthly fees. Flat-rate fees of 2.9% + $0.30 (online), 2.7% + $0.05 (in-person). International and custom accounts may incur extras; see Stripe’s full pricing.

3. Verifone (formerly 2Checkout): Global Reach for Growing Businesses

Verifone (previously 2Checkout) is tailored for SMBs seeking international expansion, bringing analytics, robust reporting, and strong security. Direct operations span over 45 countries and 100+ currencies.

Merits:

- Global reach and easy cross-border market entry.

- Transparent transaction reporting.

- Excellent for SaaS and subscription payments.

Note: Only supports online payments.

Pricing: No monthly fees; 3.5% + $0.35 per transaction (Verifone pricing).

4. Elavon (formerly Opayo/Sage Pay): A European Stalwart

Elavon is highly convenient and especially popular among online marketers and consumers across Europe. Rapid settlements, no sign-up fee, and complimentary PCI Compliance help make it a favourite.

Strengths:

- Cost-effective tiered pricing for UK/EU.

- User friendly, with round-the-clock customer support.

- Free PCI compliance pack included.

Note: No trial – requires paid sign-up.

Pricing: £32 or £45/month for up to 350 transactions, then £0.12 per additional

5. Authorize.net: The Enduring Pioneer

Authorize.net stands as a reliable solution, beloved by established businesses for decades. It enables sales in the US, Canada, UK, Australia, and parts of Europe, supporting 11 currencies.

Pillars:

- Advanced Fraud Detection Suite dramatically reduces chargebacks.

- Locate Transaction for tracing payments.

- Customizable API for multichannel support.

- Top-rated multi-channel customer service.

Peculiarity: Monthly gatekeeper fees are non-refundable.

Pricing: $25/month gateway fee, plus 2.9% + $0.30 per transaction (Authorize.net pricing).

6. Braintree: PayPal’s Sleek Sibling

Braintree is praised for its smooth modern integrations, multi-currency support, and broad reach (47 countries, 135+ currencies). It handles all major payment types and is PCI DSS Level 1 certified.

Advantages:

- Multi-currency, global support, no long-term contracts.

- No monthly, PCI compliance, or minimum transaction fees.

Considerations: Customer support occasionally inconsistent.

Pricing: 1.9% + £0.20 (UK), +1% outside UK (Braintree pricing).

7. FasterPay: An Innovative Gateway

FasterPay brings a modern, security-focused, and globally minded approach. PCI DSS Level 1 certification, customizable invoices, and a comprehensive support team set it apart for global merchants in 16+ currencies.

Strengths:

- Security for up to 6 million transactions per year.

- 24/7 customer support and exclusive consumer promotions.

Note: $9.99/month, but first month is free.

Pricing: 2.7% + $0.30 (US/Canada); 2.7% + €0.30 (Europe); 3.9% + $0.30 (RoW)

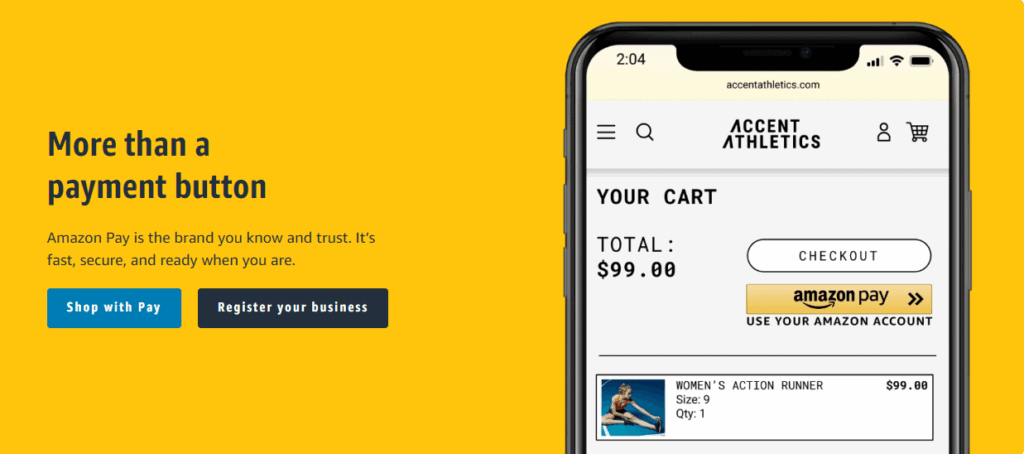

8. Amazon Pay: E-commerce Giant’s Gateway

Amazon Pay leverages shopper trust and is available in 18 nations, integrating smoothly with many platforms. Fast setup, one-click checkout, and 24/7 support are major benefits.

Advantages:

- Quick integrations and leverages the Amazon user base.

- One-click checkout experience, 24/7 support.

- 12+ currencies supported.

Note: Setup can be slower for non-Amazon sellers.

Pricing: No monthly fee. 2.9% + $0.30 (domestic), 3.9% + $0.30 (cross-border), voice-initiated higher

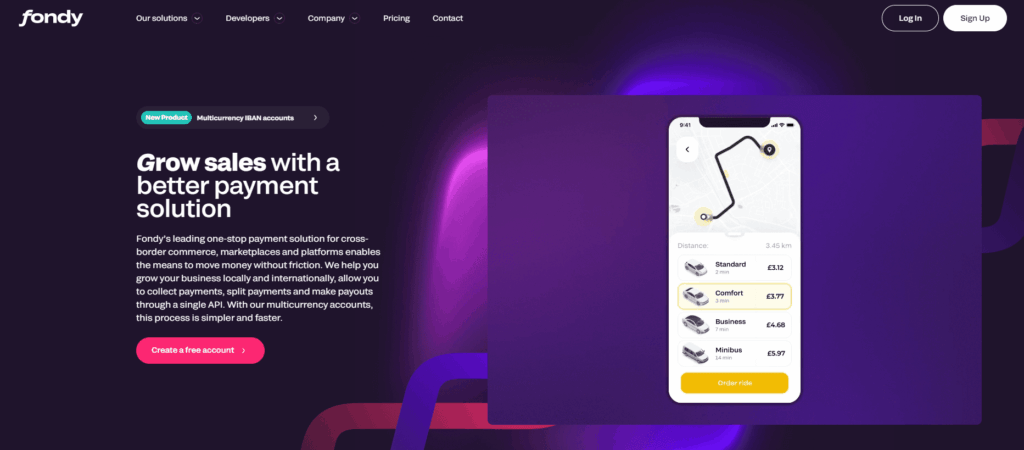

9. Fondy.io: European Excellence with Global Reach

Fondy.io began in Europe but now serves 200+ countries, supporting VISA, MasterCard, Google & Apple Pay, and 150+ currencies. Effortless integration with CMS/e-commerce platforms makes it especially appealing for shop owners.

Features:

- Seamless CMS/CRM connections.

- Multi-currency with smooth EU payouts.

- Strong security and no setup fees.

Note: No free trial.

Pricing: 0.5% + £0.20 (UK), 0.5% + €0.25 (EU)

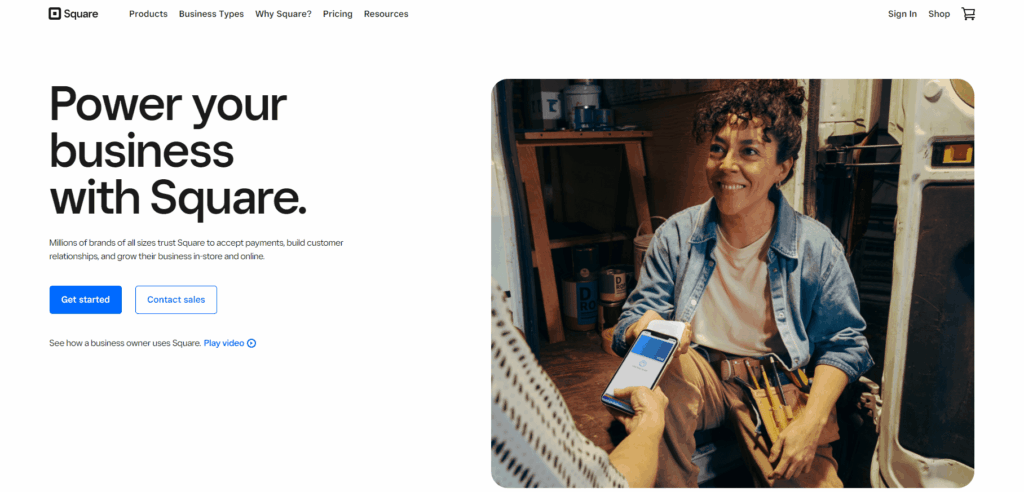

10. Square: The Point-of-Sale Champion

Especially suited for agile, startup, and mobile businesses, Square’s all-in-one platform supports online and offline sales. While Shopify and Square are competitors (so there’s no native integration), third-party apps let you link Square payments The 14 Essential Free Shopify Apps to Install and Save Your Budget.

Benefits:

- Transparent transaction pricing; no setup, authorization, or statement fees.

- Rapid bank payouts and intuitive dashboard.

Pricing: No monthly fees. 2.6% + $0.10 (card-present), 2.9% + $0.30 (online). Details at Square pricing.

Your Burning Questions Answered: Shopify Payments FAQs

What is the quintessential payment method for Shopify?

While the term “best” depends on your business and geography, PayPal is often the most popular and trusted option if Shopify Payments isn’t right for you. Still, the quintessential gateway is one matched perfectly to your customer base, fees, and features.

Can Stripe truly replace Shopify Payments?

Indeed, Stripe is a potent alternative. Shopify Payments itself is powered by Stripe. For countries where Shopify Payments isn’t available, direct Stripe integration offers the same robust infrastructure and features.

Unlocking Your Funds: How to Cash Out on Shopify

Cashing out on Shopify is straightforward: transfer funds to your linked PayPal, Stripe, or business bank account. Some e-wallets are also supported. Note that almost all platforms apply a small withdrawal charge, which can be verified in your Shopify admin or respective gateway documentation.

Is PayPal sufficient for a thriving Shopify store?

While PayPal is popular and effective, rely on more than just PayPal for best conversions. Offer a variety of gateways — cards, digital wallets, even local methods — to maximize convenience and reach. See The 14 Essential Free Shopify Apps to Install and Save Your Budget for tools that help.

Does Shopify levy a percentage on sales?

Yes, Shopify charges a transaction fee when using a third-party gateway, varying by plan:

- Basic Shopify: 2.0% on top of gateway fees

- Shopify: 1.0% on top

- Advanced Shopify: 0.5% on top

Using Shopify Payments waives these extra fees.

Personal vs. Business: Can I use my personal bank account for Shopify?

Always use a dedicated business bank account. It simplifies accounting, taxes, and legalities. For more on business setup, see Our In-Depth Guide: How to Start a Shopify Store Successfully!

Taking the Next Step: Empowering Your E-commerce Journey

Absorbing knowledge is a commendable pursuit, especially when it’s freely available (and hopefully, a little entertaining too!). But as any seasoned entrepreneur knows, true progress comes not just from understanding, but from acting on that understanding. So, to help you translate these insights into tangible improvements for your Shopify store, consider these crucial steps:

- Review the comprehensive table, and choose the payment processor that suits your business model and aspirations.

- Demand robust fraud protection for long-term financial health — prioritize security over minimal fees.

- Excellent, responsive support is non-negotiable — issues will arise from time to time.

- If you’re not satisfied with listed gateways, keep researching: the payment landscape keeps evolving.

If dropshipping, select a gateway with global readiness and fast settlements. This can dramatically improve your operational efficiency.

Concluding Thoughts: Charting Your Course to Seamless Transactions

In the vibrant world of e-commerce, the smoother your checkout process, the brighter your prospects for success. Every obstacle removed, every friction point alleviated, contributes to a more satisfying customer experience and, ultimately, a healthier bottom line for your Shopify store. Therefore, before finalizing your decision for a payment gateway, meticulously compare each option’s pricing structures, diverse features, and overall compatibility with your business ethos. By doing so, you will undoubtedly select a payment gateway that is not only reliable, secure, and user-friendly but also empowers your business to thrive in the competitive digital marketplace.

And speaking of diverse payment options, did you know your Shopify store can even embrace the future by accepting cryptocurrencies? It’s a fascinating avenue worth exploring for certain niches.

May your e-commerce voyage be prosperous and your transactions ever seamless!

About us and this blog

We are a digital marketing company with a focus on helping our customers achieve great results across several key areas.

Request a free quote

We offer professional SEO services that help websites increase their organic search score drastically in order to compete for the highest rankings even when it comes to highly competitive keywords.

Subscribe to our newsletter!

More from our blog

See all postsRecent Posts

- Dropshipping Payments: Everything You Need to Know in 2025 October 7, 2025

- Shopify Payments Alternatives: Best Payment Gateways for You October 7, 2025

- 9 Best Payment Gateways for International Transactions October 7, 2025