Last Updated on July 10, 2024 by Alexpify

Stripe is a payment platform that allows you to accept online payments from customers around the world. It supports over 135 currencies, hundreds of payment methods, and dozens of features that make it easy and secure to run an online business.

However, Stripe is not available in every country. According to its global page, Stripe currently supports 43 countries, mostly in North America, Europe, and Asia-Pacific. If you are located in a country that is not on the list, you cannot use Stripe to accept payments.

But what if you really want to use Stripe for your online business? Is there a way to bypass the restrictions and access Stripe from anywhere in the world? The answer is yes, but it is not as simple as using a VPN or a proxy. You need to establish a legitimate US business entity and connect it to your Stripe account.

This way, you can use Stripe as a US business and process payments from any country through your US entity.

This method is fully legal and compliant with Stripe’s terms of service, as long as you follow the rules and regulations of both the US and your home country. However, it also requires more effort, time, and money than using Stripe directly. You need to research the requirements and costs of setting up a US business, use a registered agent service to handle the paperwork and mail, ensure compliance with state and federal tax obligations, prepare the required business documentation, open a US business bank account, sign up for a Stripe account, integrate Stripe with your payment systems, and get paid out to your home country.

In this article, I will guide you through the detailed steps of creating a Stripe account no matter which country you live in.

Table of Contents

Registering a Business in the United States

The first step to use Stripe from restricted regions is to register a business in the United States. There are two main types of business entities that you can choose from: a limited liability company (LLC) or a corporation. Each type has its own advantages and disadvantages, depending on your business goals, needs, and preferences.

To register a business in the US, you need to choose a state where you want to form your entity. Each state has its own laws, fees, and procedures for business registration, so you need to do some research and compare the options.

Once you choose a state and a type of entity, you need to file the formation documents with the state agency, usually the Secretary of State. The formation documents include the name, address, purpose, and ownership of your business, as well as other information depending on the state and the type of entity.

However, filing the formation documents is not enough to register a business in the US. You also need to obtain an employer identification number (EIN) from the Internal Revenue Service (IRS). An EIN is a unique identifier for your business that you need for tax purposes, opening a bank account, and signing up for a Stripe account. You can apply for an EIN online, by mail, by fax, or by phone. You can find more information about how to get an EIN here

Another thing that you need to register a business in the US is a physical address. You cannot use a PO box or a virtual address for your business registration, as they are not accepted by the state agencies or the IRS. You need a real street address where you can receive official mail and documents from the government and other entities. However, this does not mean that you need to rent or buy an office or a property in the US. You can use a registered agent service to provide you with a physical address and handle your mail and documents for you.

A registered agent is a person or a company that acts as your representative in the US and receives and forwards your official mail and documents. You need to appoint a registered agent for your business in the state where you form your entity, as it is required by law.

You can find a list of registered agent services in Here

Preparing Required Business Documentation

The next step to use Stripe from restricted regions is to prepare the required business documentation. You need to have the following documents ready before you sign up for a Stripe account:

- Formation documents: These are the documents that you filed with the state agency when you registered your business, such as the articles of organization for an LLC or the articles of incorporation for a corporation. They contain the basic information about your business, such as the name, address, purpose, and ownership. You need to have a copy of these documents in PDF format.

- EIN confirmation: This is the document that you received from the IRS when you obtained your EIN. It contains your EIN and other information about your business. You need to have a copy of this document in PDF format.

- Banking details: These are the details of your US business bank account, such as the account number, routing number, and bank name. You need to have these details ready to connect your bank account to your Stripe account.

- Business address: This is the address that you used for your business registration and your EIN application. It should match the address that you provided to your registered agent service. You need to have this address ready to verify your business identity with Stripe.

- Business phone number: This is the phone number that you used for your business registration and your EIN application. It should be a US phone number that can receive calls from Stripe. You need to have this phone number ready to verify your business identity with Stripe.

Connecting Business Bank Account

The third step to use Stripe from restricted regions is to open a US business bank account and connect it to your Stripe account. You need a US business bank account to receive payouts from Stripe and to verify your business identity with Stripe. You cannot use a personal bank account or a foreign bank account for this purpose.

To open a US business bank account, you need to choose a bank that offers business banking services and meets your needs and preferences. There are many banks in the US that offer business banking services, but not all of them are friendly to foreign businesses. Some banks may require you to visit a branch in person, provide a lot of documents, or charge high fees. You need to do some research and compare the options before you choose a bank.

You can find a list of some of the best banks for foreign businesses: Wise, Mercury, Airwallex, Trynovel

Once you choose a bank, you need to apply for a business bank account online or in person. You will need to provide your business information, such as the name, address, EIN, and formation documents. You will also need to provide your personal information, such as your name, address, passport, and visa. You may also need to provide proof of your business activity, such as invoices, contracts, or website.

After you open a US business bank account, you need to connect it to your Stripe account. You can do this by logging into your Stripe dashboard and going to the Settings > Bank accounts and scheduling section. You will need to enter your banking details, such as the account number, routing number, and bank name. You will also need to verify your bank account by confirming two small deposits that Stripe will make to your account. You can find more information about how to connect your bank account to your Stripe account here

Signing Up for a Stripe Account

The fourth step to use Stripe from restricted regions is to sign up for a Stripe account and verify your business identity with Stripe. You need a Stripe account to accept payments with Stripe and to access its features and services. You also need to verify your business identity with Stripe to comply with its terms of service and to prevent fraud and money laundering.

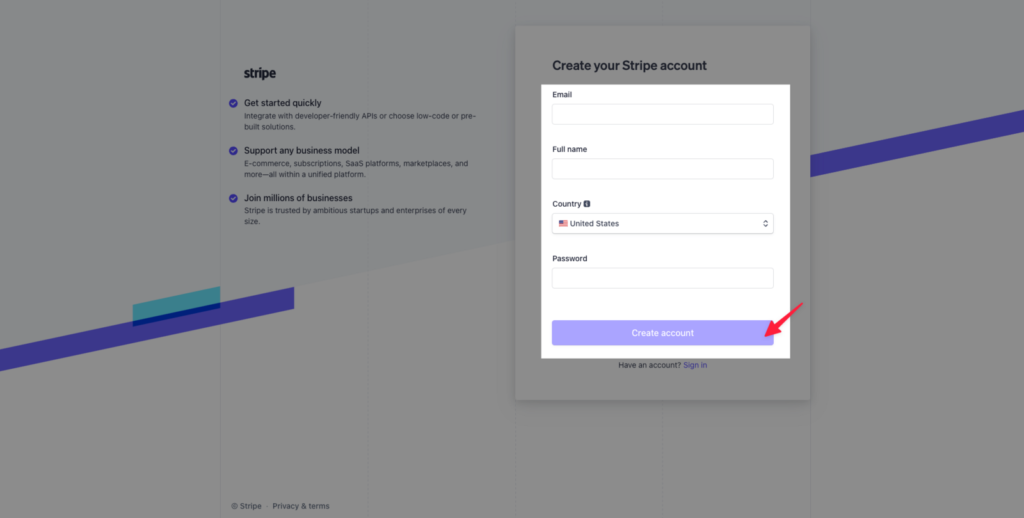

To sign up for a Stripe account, you need to go to the Stripe website and click on the Start now button. You will need to enter your email address, password, and country. You will also need to agree to the Stripe Services Agreement and the Stripe Connected Account Agreement.

After you sign up for a Stripe account, you need to verify your business identity with Stripe. You can do this by logging into your Stripe dashboard and going to the Settings > Business details section. You will need to enter your newly registered US business information, such as the name, address, phone number, EIN, and formation documents.

You will also need to enter your personal information, such as your name, date of birth, address, and passport or driver’s license.

Stripe will review your information and documents and notify you if your account is verified or if you need to provide additional information. You can check the status of your verification in your Stripe dashboard. You can also contact Stripe support if you have any questions or issues with your verification.

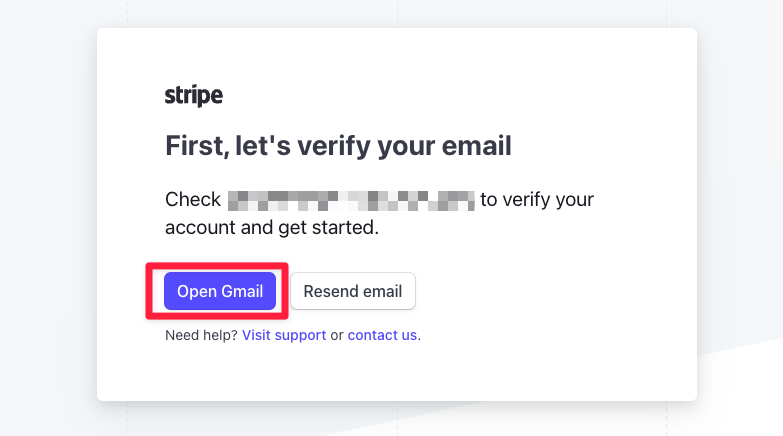

After submitting the signup form, Stripe will popup a notification that allows you to directly click on an “open email” link.

It will lead you to the email address you provided.

Once your account is verified, you can start accepting payments with Stripe and using its features and services.

Integrating Stripe with Payment Systems

The fifth step to use Stripe from restricted regions is to integrate Stripe with your payment systems and start accepting payments with Stripe. You need to integrate Stripe with your payment systems to enable your customers to pay you with their preferred payment methods, such as credit cards, debit cards, digital wallets, or bank transfers. You also need to test your integration and make sure it works properly before you go live.

To integrate Stripe with your payment systems, you need to find your API keys and use them to connect your website, app, or platform to Stripe. API keys are unique identifiers that allow you to communicate with Stripe and access its features and services. You can find your API keys in your Stripe dashboard under the Developers > API keys section. You will need two types of API keys: a publishable key and a secret key. The publishable key is used to create payment methods and tokens on the client-side, while the secret key is used to create charges and refunds on the server-side.

After you find your API keys, you need to follow the standard integration guides for the platform that you are using. Stripe supports a variety of platforms, such as WordPress, Shopify, WooCommerce, Magento, Squarespace, and more. You can also use Stripe’s own tools and libraries, such as Stripe.js, Stripe Elements, Stripe Checkout, and Stripe SDKs, to create custom payment forms and interfaces.

Once you integrate Stripe with your payment systems, you need to start testing your integration and make sure it works correctly. You can use Stripe’s test mode and test data to simulate different payment scenarios and check the results in your Stripe dashboard. You can also use Stripe’s webhooks and logs to monitor and troubleshoot your integration.

When you are satisfied with your integration and ready to accept real payments, you need to switch from test mode to live mode and update your API keys accordingly. You can do this by toggling the switch in your Stripe dashboard and replacing your test API keys with your live API keys.

By integrating Stripe with your payment systems, you can start accepting payments with Stripe and offer your customers a seamless and secure payment experience. You can also access Stripe’s features and services, such as billing, subscriptions, invoices, coupons, refunds, disputes, fraud prevention, reporting, and more.

Getting Paid Out

The final step to use Stripe from restricted regions is to get paid out to your home country and pay the required taxes and withholding on your income. You need to get paid out to your home country to access your money and use it for your personal or business needs. You also need to pay the required taxes and withholding on your income to comply with the laws and regulations of both the US and your home country.

To get paid out to your home country, you need to review the options for regular bank transfers to the owners of your US business entity. Stripe will automatically transfer the funds from your Stripe balance to your US business bank account on a regular schedule, such as daily, weekly, or monthly.

However, you cannot access your money directly from your US business bank account, as it is not linked to your personal bank account in your home country. You need to use a service that allows you to transfer money from your US business bank account to your personal bank account in your home country. There are many services that offer this option, such as TransferWise, Payoneer, PayPal, and more. You need to compare the fees, exchange rates, speed, and reliability of each service before you choose one.

Once you choose a service, you need to create an account and link it to your US business bank account and your personal bank account in your home country. You will need to provide your banking details, such as the account number, routing number, and bank name, for both accounts. You will also need to verify your identity and your business with the service, by providing your personal information, such as your name, address, passport, and visa, and your business information, such as your name, address, EIN, and formation documents.

After you create an account and link your bank accounts, you can start transferring money from your US business bank account to your personal bank account in your home country. You can do this by logging into your service account and initiating a transfer. You will need to enter the amount, the currency, and the recipient of the transfer. You will also need to confirm the fees, the exchange rate, and the delivery time of the transfer.

By transferring money from your US business bank account to your personal bank account in your home country, you can get paid out to your home country and access your money. You can also use your money for your personal or business needs, such as paying bills, buying goods, investing, or saving.

However, before you get paid out to your home country, you need to pay the required taxes and withholding on your income. You need to pay taxes and withholding to both the US and your home country, as you are earning income from both sources. You also need to avoid double taxation, which means paying taxes twice on the same income.

To pay taxes and withholding to the US, you need to file and pay federal income taxes and state income taxes to the IRS and the state agency, respectively. You also need to file and pay any other taxes that apply to your business, such as sales tax, excise tax, or franchise tax.

To pay taxes and withholding to your home country, you need to file and pay income taxes and any other taxes that apply to your business, such as value-added tax, corporate tax, or social security tax. You also need to report your foreign income and assets to your home country’s tax authority and claim any tax credits or deductions that you are eligible for.

To avoid double taxation, you need to check if there is a tax treaty between the US and your home country that reduces or eliminates the tax liability on your income. You also need to claim the foreign tax credit or the foreign earned income exclusion on your US tax return, if you qualify for them.

By paying the required taxes and withholding on your income, you can comply with the laws and regulations of both the US and your home country and avoid any penalties or fines. You can also reduce your tax liability and maximize your profit.

By following these steps, you can use Stripe from restricted regions by setting up a US business. This method is fully legal and legitimate, but it also requires more effort and compliance than using Stripe directly. You also need to be aware of the changing regulations and the potential risks that could affect your business.

Conclusion

Stripe is a powerful payment platform that allows you to accept online payments from customers around the world. However, Stripe is not available in every country, and if you are located in a restricted region, you cannot use Stripe directly. In this article, we showed you how to use Stripe from restricted regions by setting up a US business entity and connecting it to your Stripe account.

By establishing a legitimate US business entity, you can use Stripe as a US business and process payments from any country through your US entity. This way, you can access Stripe’s features and services, such as billing, subscriptions, invoices, coupons, refunds, disputes, fraud prevention, reporting, and more. You can also offer your customers a seamless and secure payment experience with their preferred payment methods, such as credit cards, debit cards, digital wallets, or bank transfers.

However, this method also has some drawbacks and challenges that you need to be aware of.

- First, it requires more effort, time, and money than using Stripe directly. You need to research the requirements and costs of setting up a US business, use a registered agent service to handle the paperwork and mail, ensure compliance with state and federal tax obligations, prepare the required business documentation, open a US business bank account, sign up for a Stripe account, integrate Stripe with your payment systems, and get paid out to your home country.

- Second, it requires more compliance and responsibility than using Stripe directly. You need to verify your business identity and your personal identity with Stripe, the IRS, the state agency, the bank, and the money transfer service. You also need to file and pay taxes and withholding to both the US and your home country, and avoid double taxation. You also need to follow the laws and regulations of both the US and your home country, and respect the rights and privacy of your customers.

- Third, it is subject to changing regulations and potential risks that could affect your business. You need to keep up with the updates and changes in the laws and policies of both the US and your home country, and adjust your business accordingly. You also need to be prepared for any issues or problems that could arise from your business registration, your bank account, your Stripe account, your payment systems, or your money transfers. You also need to protect your business from fraud, disputes, chargebacks, and hackers.

Therefore, using Stripe from restricted regions by setting up a US business is a viable and legal option, but it is not a perfect or easy solution. You need to weigh the pros and cons of this method and decide if it is worth it for your business. You also need to be diligent and careful with your business operations and transactions, and seek professional advice if needed.

We hope this article helped you understand how to use Stripe from restricted regions by setting up a US business. If you have any questions or feedback, please let us know in the comments below. Thank you for reading!