9 Best Payment Gateways for International Transactions

- October 7, 2025

- Payment gateway

Navigating the Global Marketplace: A Definitive Guide to the Best Payment Gateways for International Transactions

Estimated reading time: 11 minutes

Embarking on the journey of international e-commerce can feel akin to exploring a new continent – exhilarating yet fraught with unforeseen challenges. For entrepreneurs and businesses operating outside the United States, securing a dependable payment gateway isn't merely a convenience; it's the very bedrock of global trade. If you're specifically running a dropshipping business, understanding the best payment gateways for dropshipping can be crucial. The right gateway can transform cross-border transactions from a complex hurdle into a smooth, frictionless experience, allowing you to focus on what truly matters: serving your worldwide clientele.

This comprehensive guide serves as your trusted cartographer in the intricate landscape of global payments. We'll delve into the nuances of selecting an optimal payment solution, dissecting the top contenders, and illuminating the critical factors that pave the way for success in the international arena. Prepare to gain profound insights that will empower you to make an astute decision for your enterprise.

Key Takeaways

- A reliable international payment gateway is foundational for global e-commerce success.

- Non-US merchants face unique challenges—local payment preferences, cross-currency complexity, compliance, and fraud risks.

- Security, fee transparency, multi-currency support, and ease of integration are essential features to evaluate.

- Top global gateways include Stripe, PayPal, Authorize.net, Adyen, Shopify Payments, Verifone (2Checkout), Mollie, Skrill, and Payoneer.

- Consider user feedback, fee structures, customer support, and the ability to accept a wide range of payment methods before choosing.

- The most suitable gateway depends on your region, business model, transaction volume, technical setup, and customer base.

Table of Contents

- The Global Commerce Compass: Why Choosing the Right Payment Gateway Matters

- Unlocking Global Potential: Top Payment Gateways for International Transactions

- Decoding the Digital Wallet: A Spectrum of Payment Acceptance

- The Informed Decision: Essential Considerations for Your Business

- The Final Verdict: Charting Your Course in the Payment Landscape

- FAQ

The Global Commerce Compass: Why Choosing the Right Payment Gateway Matters

The digital storefront knows no geographical boundaries, yet the financial rails underpinning it often do. For a business to thrive globally, a robust payment infrastructure is not merely an advantage; it is an absolute necessity.

Beyond Borders: Understanding the Unique Challenges for Non-US Merchants

Many of the prominent payment processing services initially catered primarily to the US market, leaving international merchants feeling somewhat adrift. The global payment landscape presents distinct obstacles, from varying regulatory frameworks and local payment preferences to intricate currency exchange mechanisms and heightened fraud risks. A payment gateway specifically designed with international transactions in mind acknowledges these complexities and provides tailored solutions, ensuring your business can accept payments from virtually any corner of the world without a hitch. It's about ensuring your customers, whether they're in Paris or Perth, experience the same effortless checkout process.

The Pillars of Choice: What to Seek in an International Payment Gateway

- Security & Fraud Prevention: In the digital realm, trust is currency. A paramount concern for any merchant is the safeguarding of sensitive customer data and the mitigation of fraudulent activities. A superior payment gateway employs sophisticated encryption protocols, robust fraud detection tools, and adheres to stringent PCI compliance standards, acting as an impenetrable digital fortress around your transactions. Look for features like Address Verification Systems (AVS), CVV checks, and advanced machine learning for anomaly detection.

- Supported Currencies & Payment Methods: Your customers hail from diverse cultural and economic backgrounds, each with their preferred methods of payment. An ideal gateway should offer extensive multi-currency support and a broad spectrum of payment options, ranging from ubiquitous credit and debit cards (Visa, Mastercard, Amex) to popular digital wallets (Apple Pay, Google Pay, PayPal) and local bank transfers. The more options you provide, the wider your net for capturing global sales.

- Fee Structures & Transparency: The cost associated with processing payments can significantly impact your bottom line. It's imperative to meticulously examine the fee structure, which typically includes setup fees, transaction percentages, fixed per-transaction charges, and sometimes monthly maintenance fees or withdrawal fees. Opt for providers that offer clear, straightforward pricing without hidden surcharges, ensuring you can accurately forecast your operational expenses.

- Integration & Ease of Use: A payment gateway, however powerful, should integrate seamlessly with your existing e-commerce platform or website. Whether you're utilizing Shopify, WooCommerce, or a custom-built solution, the integration process should be intuitive, ideally leveraging straightforward APIs or readily available plugins. An overly complex setup can lead to unnecessary delays and technical headaches. Furthermore, the merchant interface should be user-friendly, offering clear dashboards for transaction monitoring and reporting.

- Customer Support Responsiveness: Even the most sophisticated systems can encounter unexpected issues. When problems arise, prompt and knowledgeable customer support is invaluable. Prioritize providers known for their accessible, efficient, and multilingual support channels, be it through phone, chat, or email, to ensure minimal disruption to your business operations.

Unlocking Global Potential: Top Payment Gateways for International Transactions

With a clear understanding of what constitutes an exemplary payment gateway for global commerce, let's explore some of the industry's leading solutions, each offering distinct advantages for non-US merchants.

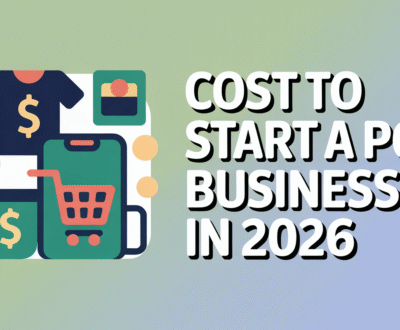

1. Stripe: The Developer's Gateway to Global Reach

- Overview & Strengths: Stripe provides a robust, highly customizable infrastructure for accepting payments online. Its comprehensive suite of APIs empowers developers to integrate payment functionalities precisely to their specifications, supporting a vast array of business models. Merchants appreciate its powerful fraud protection tools and real-time analytics, offering granular insights into transaction volumes and consumer trends. It's also the technological backbone for services like Shopify Payments.

- Key Features for International Commerce: Stripe boasts impressive multi-currency support and facilitates payments in over 47 countries, handling major global currencies like the Euro, Pound Sterling, and US Dollar with ease. Its capabilities extend to managing recurring billing and offers programmatic dispute handling, automating a process that can often be tedious for international merchants.

- Fee Structure Insight: Stripe's fees are known for their transparency, generally starting around 2.9% + 30¢ (or local currency equivalent) per transaction. While straightforward, some specialized transactions or international card usage might incur slightly higher costs.

- Global Footprint and Ideal Users: Stripe enjoys a significant global presence, particularly strong in countries like Japan, Latvia, Mexico, Poland, and Singapore, among many others. Its advanced features and technical depth make it ideally suited for tech-savvy businesses, developers, and those requiring significant customization for their international payment flows.

2. PayPal: The Veteran of Digital Payments

- Overview & Strengths: PayPal offers a quick, secure, and reliable method for sending and receiving money across borders. Its brand recognition alone instills confidence in consumers, making it a powerful conversion tool for international sales. For small to medium-sized enterprises and startups, its intuitive interface and seamless integration with most e-commerce platforms are significant advantages.

- International Transaction Dynamics: Operating in over 200 countries and supporting numerous currencies, PayPal's global reach is undeniable. However, for international transactions, the fee structure can hover around 2.9% plus a fixed fee determined by the received currency.

- Considering the User Experience & Support: While incredibly convenient for customers, merchants occasionally voice concerns regarding PayPal's dispute resolution processes and instances of account limitations, especially within high-volume or dropshipping contexts. Its responsiveness to inquiries on public review platforms has, at times, been a point of contention.

- Global Footprint and Ideal Users: PayPal is overwhelmingly popular worldwide, with a particularly strong presence in markets such as Egypt, Israel, India, Japan, and the Philippines. It is an excellent choice for businesses prioritizing broad customer accessibility and for dropshippers, despite some of the operational challenges reported by a segment of merchants. For a broader overview of payment solutions tailored for this business model, delve into our guide on dropshipping payments.

3. Authorize.net: A Foundation of Secure Processing

- Overview & Strengths: This gateway offers a secure, reliable, and convenient platform for processing online payments. Its core strengths lie in its comprehensive fraud protection mechanisms and strong security features, which include protection against chargebacks and 24/7 customer support via phone, chat, and email, alongside automated dispute handling.

- Security Features & Fraud Management: Emphasizing security, Authorize.net implements advanced tools to shield both merchants and customers from fraudulent activities. This focus on data integrity and transaction safety provides a strong foundation for international transactions.

- Pricing Model for International Merchants: Authorize.net typically involves a fixed monthly plan, usually around $25, in addition to per-transaction fees starting from approximately 2.9% + 30¢. While no setup fees are generally charged, the monthly commitment is a factor to consider.

- Global Footprint and Ideal Users: Despite some mixed reviews on public platforms regarding customer service, Authorize.net maintains a strong international user base, particularly popular in the United Arab Emirates, Germany, Sweden, Austria, and Switzerland. It remains a viable option for businesses prioritizing established security protocols and a comprehensive feature set for their global operations.

4. Adyen: The Enterprise Solution for Seamless Global Trade

- Overview & Strengths: Adyen provides a unified platform that handles payment processing, risk management, and settlement across various channels, including online, in-app, and in-store. It's renowned for its scalability, advanced fraud protection, and support for over 40 payment methods globally. Its elegantly designed interface simplifies complex payment management.

- Advanced Capabilities for Large-Scale Operations: Tailored for businesses with substantial transaction volumes and a need for extensive international reach, Adyen offers flexible payout options and a single integration point for numerous markets. This reduces operational complexity for businesses operating across many different countries.

- Fee Structure for High Volume: Adyen operates on a model with a fixed processing fee, typically around EUR 0.10 per transaction, complemented by interchange fees that vary based on the chosen payment method. While not necessarily suited for small businesses due to its enterprise focus and potentially higher costs for lower volumes, it provides excellent value for large-scale operations.

- Global Footprint and Ideal Users: Though headquartered in Europe, Adyen has expanded its global footprint significantly, serving major markets in the US, China, Brazil, Russia, and Japan. It is the quintessential choice for large-scale international businesses and enterprises requiring a highly robust, scalable, and globally integrated payment solution.

5. Shopify Payments: Tailored for the Shopify Ecosystem

- Overview & Strengths: Directly embedded within the Shopify platform, this payment gateway provides unparalleled convenience. It includes integrated fraud protection, supports multiple currencies, and offers real-time analytics directly within your Shopify dashboard. Its primary strength lies in its seamless, native integration, simplifying payment management for Shopify store owners.

- Seamless Integration & Benefits: The most compelling advantage is the cohesive experience it provides. Merchants avoid transactional fees from third-party gateways on sales processed through Shopify Payments, streamlining costs and administrative overhead. The setup is remarkably straightforward, often just a few clicks.

- Fee Structure within Shopify: Transaction fees vary depending on your chosen Shopify plan, typically ranging from 2.4% to 2.9% plus 30¢ per transaction. It's worth noting that Shopify Payments is powered by Stripe in many regions, meaning where one is available, the other might be less prevalent as an independent option.

- Global Footprint and Ideal Users: Shopify Payments is incredibly popular in countries with strong Shopify adoption, including Australia, Austria, Finland, France, Germany, New Zealand, and Sweden. It is the unequivocal choice for any merchant leveraging the Shopify platform, particularly those focused on international sales within the supported regions. However, if you're exploring other options, we also have a dedicated guide on Shopify Payments Alternatives. To dive deeper into its functionalities and benefits, you can read our comprehensive guide on Shopify Payments.

6. Verifone (Formerly 2Checkout): Expanding Horizons for Merchants

- Overview & Strengths: Verifone facilitates sales in over 200 countries and supports a multitude of currencies, positioning itself as a truly global solution. It emphasizes impressive security features, robust fraud protection, and provides real-time data analysis, empowering merchants with actionable insights to inform their strategic decisions. It also offers access to recurring billing capabilities.

- Extensive Global Reach: One of Verifone's standout attributes is its wide operational footprint, enabling merchants to accept payments from a vast global customer base without requiring credit card-specific requirements. This broad reach is a significant draw for businesses with diverse international markets.

- Understanding Fee Variations: While general transaction fees hover around 3.5% plus 30¢, it's critical for merchants to be aware of potential additional fees. Verifone applies surcharges for businesses operating in what it classifies as "high-risk" countries, which could increase overall processing costs due to elevated fraud indicators in those regions.

- Global Footprint and Ideal Users: Verifone enjoys considerable popularity in European markets such as Germany, France, Greece, Italy, Netherlands, Poland, Portugal, and Spain. It is well-suited for businesses aiming for extensive international market penetration and those needing strong security features across numerous territories.

7. Mollie: The European E-commerce Enabler

- Overview & Strengths: Mollie provides a secure, reliable, and convenient platform, distinguishing itself with a customer service team that actively responds to inquiries – a refreshing trait in the industry. It supports over 30 distinct payment methods and multiple currencies, including Euros, Pound Sterling, and US Dollars, making it highly versatile for European commerce.

- Diverse Payment Methods for Europe: Its strong presence in Europe means it supports a wide array of local payment methods popular in various European countries, alongside major international cards. This adaptability is crucial for optimizing conversion rates within the diverse European market.

- Transparent Fee Model: Mollie's fee structure is notably transparent, often operating on a pay-per-transaction basis with no long-term contracts. For EU customers using Mastercard and Visa, a flat rate of €0.25 plus 1.8% is common, with international transactions potentially reaching 2.8%. Custom pricing is available for businesses generating over €50,000 (approximately $53,000 US dollars) in revenue.

- Global Footprint and Ideal Users: Mollie's core strength lies within Europe, with a particularly strong user base in the Netherlands and Germany, though it also has a notable presence in the United States. It is an excellent choice for businesses primarily targeting the European market, valuing transparent pricing, diverse payment options, and responsive customer support.

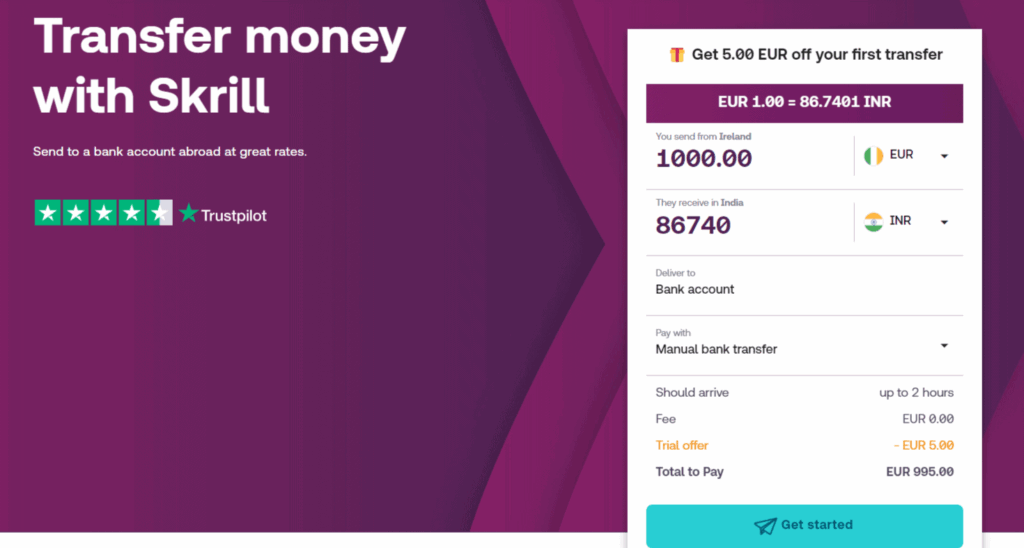

8. Skrill: The Agile Solution for Digital Goods & Gaming

- Overview & Strengths: Skrill specializes in quick, real-time payment settlements, making it an attractive option for businesses where speed of transaction is paramount. It offers low fees, no hidden charges, and prides itself on transparent operations. Its partnerships with major e-commerce platforms have expanded its reach to over 40 countries.

- Focus on Speed and Low Fees: A key advantage of Skrill is its competitive pricing structure. Bank transfers often incur no service charge, while international transfers typically range from 1% to 4.99%, depending on the currency. This focus on cost-efficiency appeals to businesses with high transaction volumes or those managing frequent international payouts.

- International Transfer Costs: Merchants should be mindful that service fees can fluctuate based on the specific currency being used for transfers. However, Skrill's overall commitment to minimizing costs for cross-border transactions remains a significant draw.

- Global Footprint and Ideal Users: While deeply entrenched in the UK and European markets, Skrill is steadily gaining traction in other regions, including Australia, Canada, India, Thailand, and Mexico. It is an ideal gateway for businesses involved in digital content, online gaming, and those that prioritize fast, low-cost international money transfers.

9. Payoneer: Connecting Global Freelancers and Businesses

- Overview & Strengths: With an impressive 18-year tenure, Payoneer enables businesses to receive payments from over 150 countries in various currencies. A standout feature is its live chat support, available even to non-customers, facilitating immediate assistance and clarity. The platform is proactive in addressing customer queries across multiple channels, including app stores, demonstrating a commitment to user satisfaction.

- Facilitating Cross-Border Payments: Payoneer excels at simplifying the process of receiving funds from international clients and marketplaces. It allows businesses to maintain balances in multiple currencies, reducing conversion costs and providing flexibility in managing global income.

- Competitive Fee Structure: Payoneer offers a highly competitive fee model. Transfers between Payoneer accounts are entirely free, a significant benefit for businesses and individuals within its network. Other transactions involving currency exchange are calculated at the time of the transaction, typically averaging around 2% per transaction.

- Global Footprint and Ideal Users: Having a long-standing history, Payoneer has cultivated a vast global network. It is widely used in the United Kingdom, Australia, India, Canada, Japan, South Africa, and Brazil, among countless other nations. Payoneer is an excellent solution for freelancers, digital nomads, and businesses that frequently engage in international payments and require efficient, low-cost cross-border money transfers.

Decoding the Digital Wallet: A Spectrum of Payment Acceptance

The evolution of payment methods has been swift and transformative. Today's global merchant must be adept at accepting a broad spectrum of payment instruments to cater to diverse customer preferences.

Embracing Modern Payment Methods

- Credit and Debit Cards: The Enduring Mainstays: Despite the emergence of newer technologies, credit and debit cards (Visa, Mastercard, American Express, Discover) remain the most universally accepted forms of payment. A reputable payment gateway will always prioritize robust support for these foundational instruments, often integrating them directly into its service offerings. Many gateways even provide branded MasterCard or Visa options within their plans.

- Digital Wallets: The Rise of Convenience: Digital wallets, sometimes referred to as e-wallets, have surged in popularity, driven by the ubiquity of smartphones. Services like Apple Pay, Google Pay, Amazon Pay, PayPal, and Venmo allow customers to securely store payment information and complete transactions with a single tap or click. Integrating these options significantly enhances customer convenience, reduces checkout friction, and boosts conversion rates, especially on mobile devices. Consider how Skrill or PayPal can connect through Apple Pay, eliminating the need for physical cards.

- Bank Transfers: The Direct Approach: For larger transactions or in regions where direct bank transfers are culturally preferred, facilitating these payments is crucial. Many payment gateways offer integrated solutions for initiating and receiving bank transfers, providing a straightforward, albeit sometimes slower, method of payment.

- Alternative Payments: Beyond the Traditional: The payment landscape is continually innovating. Some progressive payment gateways also embrace alternative methods such as local payment schemes, installment plans, and even cryptocurrencies like Bitcoin. If you're running a Shopify store and wondering how to integrate these options, explore our guide on how to accept Bitcoin and other crypto payments on Shopify. While not universally adopted, offering these specialized options can cater to niche markets and demonstrate a forward-thinking approach.

The Informed Decision: Essential Considerations for Your Business

Choosing a payment gateway is a strategic decision that impacts operational efficiency, customer satisfaction, and financial health. Beyond the features of individual providers, a holistic assessment is imperative.

Beyond the Numbers: Scrutinizing Fees and Charges

Every payment gateway operates as a business, generating revenue through various fee structures. It is incumbent upon you to meticulously compare not only the advertised percentage rates but also any associated fixed fees, monthly maintenance charges, setup costs, and potential hidden fees such as chargeback fees or inactivity penalties. For instance, Skrill levies a monthly service fee of EUR 5.00 (approximately $5.30 US dollars) if no transactions are made within a six-month period. Understanding the total cost of ownership involves a careful audit of all potential charges, specific to your transaction volume, average ticket size, and geographical customer base.

Fortifying Your Fortress: Prioritizing Security and Fraud Protection

- Advanced Encryption: Protecting sensitive payment data during transmission.

- Comprehensive Fraud Protection Tools: Including real-time monitoring, AI-driven anomaly detection, and customizable risk rules.

- Multi- or Two-Factor Authentication (MFA/2FA): Adding an extra layer of security for merchant accounts.

- Data Privacy Compliance: Adherence to global regulations like GDPR and local data protection laws.

- Address Verification System (AVS): Matching the billing address provided by the customer with the address on file with the card issuer.

- PCI DSS Compliance: The industry standard for payment card data security.

The Voice of Experience: Leveraging Peer Reviews and Reputation

Never underestimate the power of collective experience. Before finalizing your decision, dedicate ample time to research and read reviews from other users. Platforms like Trustpilot and G2 provide invaluable insights into the real-world performance of various payment gateways. Pay particular attention to comments regarding:

- Fund Holding Policies—some gateways are notorious for holding funds for extended periods, which can severely impact a business's cash flow, especially for operations reliant on consistent capital for marketing campaigns and inventory.

- Customer Support Quality—as previously mentioned, responsive and effective customer service is paramount when issues arise.

- Ease of Integration and Use—user experiences often highlight practical challenges or benefits of a platform's interface and integration capabilities.

A thorough review of peer feedback can unveil potential red flags or hidden advantages that aren't immediately apparent in promotional materials, guiding you towards a reliable and merchant-friendly solution.

The Final Verdict: Charting Your Course in the Payment Landscape

The world of international e-commerce presents an immense opportunity, and your choice of payment gateway is a pivotal factor in harnessing that potential. We've traversed the landscape of leading providers, from the developer-centric power of Stripe to the global ubiquity of PayPal, and the niche strengths of Mollie, Skrill, and Payoneer. Each offers a unique blend of features, fee structures, and global reach.

In our expert estimation, a discerning approach involves first filtering options based on their demonstrated reliability and customer satisfaction, as reflected in independent reviews. Mollie, Payoneer, and Skrill, for example, often exhibit strong ratings and proactive engagement with their user bases on platforms like Trustpilot. Subsequently, your ultimate selection should align seamlessly with your business's specific requirements.

Consider the diverse payment methods your target international audience prefers, meticulously compare the nuanced fee structures that apply to your projected transaction volumes and geographical spread, and, above all, prioritize the impregnable security features that will protect your enterprise and foster customer trust. With these insights, you are well-equipped to chart a successful course in the dynamic world of global digital commerce.

FAQ

What is the most trusted payment gateway for international transactions?

Stripe and PayPal are among the most trusted globally, but the best choice depends on your specific needs, target countries, and integration requirements. Mollie and Payoneer also enjoy excellent ratings for transparency and customer service. Always review independent feedback and regional availability before making a final decision.

Which payment gateway is best for dropshipping?

The best payment gateways for dropshipping are usually PayPal, Stripe, Shopify Payments, and Payoneer, due to their broad acceptance, e-commerce platform compatibility, and support for recurring and international transactions.

What should I check in a payment gateway's fee structure?

Evaluate all components: percentage and flat fees per transaction, monthly maintenance or inactivity charges, potential withdrawal or chargeback fees, and any cross-border or "high-risk" country surcharges.

Can I accept cryptocurrencies on my international e-commerce store?

Yes, several gateways support crypto. For Shopify stores, here’s a guide on how to accept Bitcoin and other crypto payments on Shopify.

What’s the fastest way to begin accepting global payments?

Most gateways offer rapid onboarding, but Shopify Payments (for Shopify stores), Stripe, and PayPal typically provide the swiftest approval and integration processes for new merchants.

How do I protect my international business from payment fraud?

Choose gateways with robust, multi-layered fraud defenses (AVS, 2FA, real-time monitoring, PCI DSS compliance) and create strict internal policies for reviewing and approving large or suspicious orders.

About us and this blog

Alexpify is a knowledge hub for entrepreneurs who want to master Shopify dropshipping and global e-commerce. Founded by Alex, the blog shares practical guides, real insights, and step-by-step tutorials that simplify online business for everyone — from beginners to full-time digital sellers.