Sole Proprietorship vs LLC for Dropshipping: Which is Best?

- October 6, 2025

- Payment gateway

Sole Proprietorship vs. LLC for Dropshipping: Which Path Will You Choose?

Estimated reading time: 12 minutes

- Choosing between a Sole Proprietorship and LLC shapes your dropshipping journey's risk, credibility, and long-term potential.

- A Sole Proprietorship offers speed and simplicity, but leaves your personal assets vulnerable.

- An LLC provides liability protection, professional status, and tax flexibility—ideal for serious, scaling dropshippers.

- Starting right with the correct structure can make the difference between stress and sustainable growth.

- Don’t fall for common myths—LLCs can be simple, affordable, and even available to non-US residents.

- My Journey: Navigating the Business Structure Maze in Dropshipping

- Demystifying the Basics: What Are We Talking About?

- The Nitty-Gritty: A Head-to-Head Comparison

- Dropshipping Realities: Why Your Choice Matters

- Debunking the Myths: Common Misconceptions Exposed

- My Final Counsel: Guiding Your Decision

- Beyond the Structure: Your Next Steps in Dropshipping

- FAQ

My Journey: Navigating the Business Structure Maze in Dropshipping

Starting a dropshipping venture is incredibly exciting, isn't it? I remember those early days. The rush of finding winning products, setting up a store and imagining those first sales. But amidst that excitement, many new entrepreneurs, myself included at one point, overlook a crucial decision: selecting the right business structure. This isn't just a minor detail; it’s a foundational choice that profoundly impacts your operation.

Are you pondering whether a Sole Proprietorship or an LLC is better for your dropshipping business? This question can feel daunting. Believe me, I’ve been there. You’re not alone in seeking clarity. Through years in online business, I’ve learned the nuances. I’m here to simplify these concepts for you. By the end of our discussion, you’ll possess a clear understanding. You will know exactly which structure aligns with your current situation and future aspirations.

Demystifying the Basics: What Are We Talking About?

Before we dive into the comparative analysis, let's establish a clear understanding. What exactly defines a Sole Proprietorship? And what benefits does a Limited Liability Company (LLC) offer? Grasping these core definitions is your first step. It sets the stage for an informed decision.

The Solo Act: Understanding a Sole Proprietorship

Imagine you’re running a one-person show. That’s essentially a Sole Proprietorship. It's the most straightforward business formation. In fact, if you start selling products online without any formal registration, you're likely already operating as one. There’s no legal distinction between you and your business. You are the business.

This structure boasts simplicity. You don't typically need to file extensive paperwork to commence operations. Perhaps you'll register a "Doing Business As" (DBA) name. This allows you to trade under a business name rather than your personal one. Such a process is generally quick and inexpensive. Startup costs are minimal, often zero. You avoid registration fees, annual renewals, or separate business licenses in many regions. Taxation is also simple. Your business income reports directly on your personal tax return. There’s no separate business filing required.

This direct approach, however, comes with a significant trade-off. There is no legal separation. Your personal assets remain exposed to business liabilities. A customer dispute, a supplier issue, or a legal claim could put your savings, home, or vehicle at risk. I've seen situations where this lack of protection caused immense stress. You are personally responsible for all business debts and obligations. This structure is akin to an open-ended personal guarantee.

Image Request: A lone individual standing on a tightrope, carefully balancing various items representing business tasks and personal assets, with a subtle hint of risk below.

The Shielded Entity: Unpacking the LLC

Now, let's consider the Limited Liability Company, or LLC. This structure creates a legal barrier. It separates your personal assets from your business liabilities. Your dropshipping store, under an LLC, becomes its own distinct legal entity. It’s no longer just "you" running a shop. It's a recognized business.

The primary advantage is evident in its name: Limited Liability. Should your business face legal challenges or debts, your personal assets are typically shielded. This protection is invaluable, offering peace of mind. It allows you to take calculated risks without jeopardizing your personal wealth. I often advise dropshippers, once they achieve consistent sales, to seriously consider this structure. It’s like equipping your business with a robust defense mechanism.

This protection isn't absolute, however. You must maintain clear separation between business and personal finances. Committing fraud or commingling funds can lead to "piercing the corporate veil." This means losing your liability protection. So, diligence is key. An LLC also enhances your business's credibility. When you interact with banks, payment processors like Stripe or PayPal, or even potential suppliers, an LLC projects a professional image. It signals you're serious about your operations. Moreover, LLCs offer tax flexibility. While typically taxed like a sole proprietorship by default, you can elect to be taxed as an S-Corporation in the US. This can lead to substantial savings on self-employment taxes as your profits grow.

Image Request: A strong, stylized shield protecting a small, growing e-commerce store icon, with a person standing confidently beside it, indicating separation and security.

The Nitty-Gritty: A Head-to-Head Comparison

Understanding the definitions is merely the beginning. Let’s place these two structures side-by-side. This direct comparison highlights their practical differences. It reveals how each might uniquely serve a dropshipping operation. Which path truly aligns with your entrepreneurial spirit?

| Aspect | Sole Proprietorship | Limited Liability Company (LLC) |

|---|---|---|

| Setup Process | Immediate; just start selling | Requires formal state filing; slower |

| Initial Cost | Minimal, often $0 - $50 (DBA fee) | Typically $50 - $500+ (varies by state/country) |

| Legal Protection | None; personal assets are at risk | Provides liability shield; separates personal from business assets |

| Tax Structure | Simple; reported on personal tax return | Flexible; default is personal, but can elect S-Corp for tax savings |

| Banking & Finance | Often harder to secure dedicated business accounts or lines of credit | Easier approval for business bank accounts, credit cards, and payment processors |

| Professional Image | Less formal; often operates under your personal name | More credible; recognized business name enhances professionalism |

| Administrative Burden | Minimal; few ongoing requirements | Moderate; involves annual reports, renewal fees, and better record-keeping |

| Scalability & Growth | Limited; not ideal for significant expansion or attracting investment | High; better suited for scaling, brand building, and attracting partners |

| Continuity | Directly tied to the owner; ceases with owner's exit | Provides continuity; business can persist regardless of ownership changes |

| Transferability | Difficult to transfer or sell as a separate entity | Easier to transfer ownership or sell the business entity |

The table above presents a concise overview. You can see the immediate trade-offs. A Sole Proprietorship offers quick entry, but an LLC provides a robust framework for expansion and security. For instance, forming an LLC typically involves filing articles of organization with your state. This step formalizes your business existence. While it requires an initial investment, ranging from perhaps $50 to $500 or more in the US, this cost often pays for itself through enhanced protection and opportunities. I’ve found that many entrepreneurs hesitate due to these upfront fees. However, consider it an investment in your business’s future resilience.

Dropshipping Realities: Why Your Choice Matters

Beyond the general business aspects, specific considerations arise within dropshipping. These realities often dictate the most prudent business structure. I’ve seen firsthand how these factors can shape a dropshipper’s journey. Let's explore them.

The Gatekeepers: Payment Processors and Your Business

This aspect is critically important. Payment processors are your financial lifeblood. They handle customer transactions and funnel revenue into your accounts. Companies like Stripe, PayPal, and Shopify Payments enforce stringent rules. An account flag or freeze can effectively halt your business. Your funds might remain inaccessible for months. I experienced a payment hold early on. It was a nerve-wracking period.

Sole Proprietors often face increased scrutiny. You appear as an individual selling online. This can sometimes trigger flags for higher risk. An LLC, conversely, projects legitimacy. You operate under a registered business name. You possess official formation documents. You maintain separate business banking. These elements build confidence with payment platforms. Some processors even mandate an LLC or an Employer Identification Number (EIN) as your revenue climbs. If you envision substantial sales, an LLC mitigates risks. It facilitates quicker approval. It ensures your cash flow remains uninterrupted.

Building Alliances: Suppliers and Your Credibility

Dropshipping success often hinges on strong supplier relationships. Whether you work with platforms like Zendrop or private agents, your suppliers' perception of you matters. Believe me, they take an LLC more seriously. I’ve seen this repeatedly.

An LLC conveys professionalism. It signals commitment. This can translate into tangible benefits. Suppliers may offer better pricing structures. They might provide expedited shipping options. You could gain access to private labeling or custom packaging. These advantages are rarely extended to individual sellers. When your outreach originates from "support@yourstore.com" backed by an LLC, it speaks volumes. It tells them you’re a genuine business partner, not merely a casual seller. This distinction can significantly impact your operational efficiency and profit margins.

The Inevitable: Returns, Refunds, and Legal Headaches

In dropshipping, customer returns and chargebacks are simply part of the game. Not every product satisfies every customer. Disputes arise. Complaints occur. It's an unavoidable aspect of e-commerce.

If you operate as a Sole Proprietor, you bear personal responsibility. Any significant customer complaints or legal claims directly impact your personal assets. Imagine a scenario where a product allegedly causes harm. Or a chargeback dispute escalates. Your personal finances are on the line. With an LLC, your personal assets are typically shielded. This provides a crucial layer of protection. It allows you to address these issues professionally without personal financial jeopardy. Furthermore, an LLC simplifies the implementation of clear refund policies. It enables you to hire virtual assistants for support. It helps build a professional customer service system. You're creating a robust framework, not just handling problems manually.

The Tax Man Cometh: Financial Flexibility and Savings

Both Sole Proprietors and LLCs can deduct legitimate business expenses. Think Shopify subscriptions, Facebook Ads, or inventory costs. These deductions reduce your taxable income. However, an LLC offers superior tax flexibility, particularly in the US.

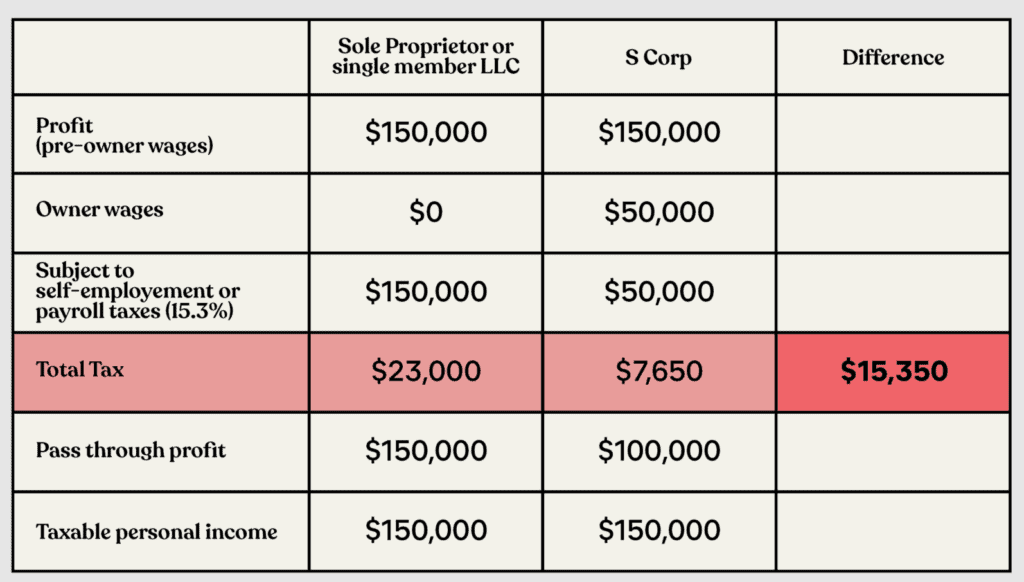

As an LLC owner, you can elect to be taxed as an S-Corporation. This strategic choice can yield significant savings on self-employment taxes. This becomes particularly impactful once your annual profits exceed certain thresholds, perhaps $50,000 or more. I’ve guided clients through this transition. It often results in thousands of dollars in annual tax savings. This flexibility isn't available to Sole Proprietors. It represents a powerful incentive for serious dropshipping entrepreneurs. Consult with a tax professional, of course, to understand the specifics for your situation.

Crafting a Legacy: Branding, Trust, and Long-Term Vision

People buy from brands they trust. In the crowded dropshipping landscape, trust is currency. Operating as an LLC signals that your store is a genuine, established business. This formality empowers you.

An LLC allows you to formally register a trademark for your brand name and logo. You can establish a dedicated business bank account. You can apply for business credit cards. These actions contribute to a stronger brand identity. They also provide financial tools for growth. Should your business scale significantly, an LLC positions you favorably to attract investors or partners. Most successful dropshipping brands, those achieving six and seven-figure revenues, operate as LLCs or corporations. They understand the importance of a solid legal foundation. This structure provides continuity and transferability, allowing your business to endure and evolve beyond your direct involvement, unlike a Sole Proprietorship tied solely to you.

Debunking the Myths: Common Misconceptions Exposed

The online space is rife with advice about business structures. Some of it is helpful, some less so. Let’s address some prevalent misconceptions. These often deter aspiring dropshippers from making informed choices.

"I'm Too Small for an LLC!"

I hear this frequently. The reality is, you don’t need to be generating massive profits to benefit from an LLC. Even if you're pulling in $1,000 (€900) per month, you’re already exposed to risks. Payment processor holds, supplier disputes, customer complaints – these issues don't discriminate based on revenue. An LLC acts like an essential insurance policy. You hope you never need it, but you'll be incredibly grateful for its protection if something goes awry. It’s about proactive risk management.

"LLCs are a Financial Burden and Too Complex!"

This is another common misconception. Forming an LLC is often simpler and more affordable than many realize. In numerous US states, the registration fee is under $200 (€180). Some states charge even less than $100 (€90). You typically don't require a lawyer for the initial setup. Many entrepreneurs successfully utilize affordable online services or complete the process themselves. While there are ongoing compliance requirements, like annual reports and fees, these are manageable. They become part of running a professional operation.

"More Taxes? No, Thank You!"

This myth causes undue concern. For most dropshippers, an LLC doesn't automatically mean higher taxes. By default, a single-member LLC is taxed identically to a Sole Proprietorship. Your profits and losses still flow through to your personal tax return. In fact, forming an LLC provides more options for tax optimization later on. Electing S-Corp status, once your profits are consistent, can lead to substantial tax savings. It's a strategic advantage, not a tax burden.

"Only US Residents Can Form a US LLC!"

Absolutely untrue. I’ve worked with numerous international clients. They form US-based LLCs for their dropshipping businesses. Many choose states like Wyoming or Delaware due to their favorable business laws. This strategy opens doors. It allows non-US residents to use US payment processors like Stripe. For guidance on obtaining your Employer Identification Number (EIN) as an international entrepreneur, refer to our detailed article. It facilitates selling to the lucrative US customer base. It enhances trust with suppliers. It grants better access to various e-commerce tools and platforms. While it involves a bit more administrative effort for non-residents, it is entirely feasible. The benefits often far outweigh the complexities.

My Final Counsel: Guiding Your Decision

Alright, we've explored both sides of this coin. The honest truth is, both a Sole Proprietorship and an LLC can function for a dropshipping business. The optimal choice, however, depends entirely on your current stage. It hinges on your aspirations and your comfort with risk. Let me offer some direct guidance.

When a Sole Proprietorship Might Be Your Starting Line

- You are just beginning your dropshipping journey.

- You're experimenting with product ideas.

- You are generating minimal or no revenue.

- You prioritize simplicity and minimal overhead costs.

- You're not yet ready for a full commitment to the business structure.

If your dropshipping store functions as a side hustle, or you’re still refining your operational model, a Sole Proprietorship is fast, easy, and perfectly acceptable for short-term engagement. It allows you to dip your toes into the water without significant upfront investment.

When an LLC Becomes Your Growth Engine

- You are achieving consistent sales and growing revenue.

- You seek to protect your personal assets from business liabilities.

- You are committed to building a serious, long-term brand.

- You plan to scale your operations significantly.

- You desire enhanced credibility with partners and customers.

An LLC furnishes you with an essential safety net. It provides the flexibility required for growth. It bestows the credibility necessary for sustained success. Many successful dropshippers start as Sole Proprietors and wisely upgrade to an LLC once their business gains momentum. It's a strategic evolution.

About us and this blog

Alexpify is a knowledge hub for entrepreneurs who want to master Shopify dropshipping and global e-commerce. Founded by Alex, the blog shares practical guides, real insights, and step-by-step tutorials that simplify online business for everyone — from beginners to full-time digital sellers.