Last Updated on July 10, 2024 by Alexpify

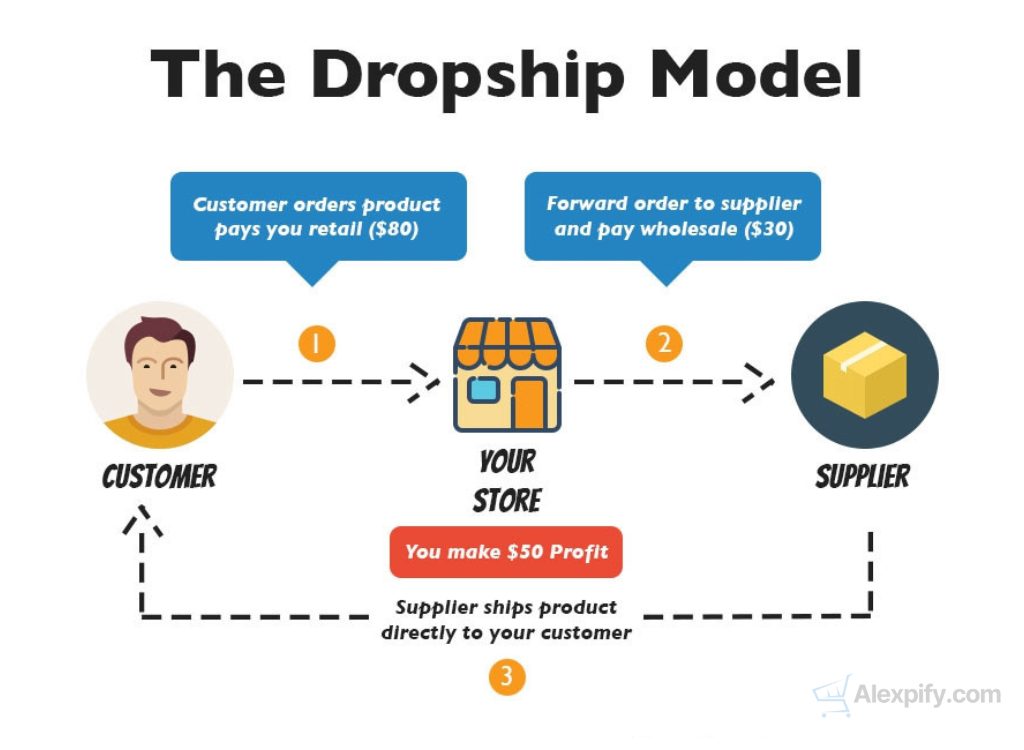

Dropshipping has exploded in popularity over recent years as an ecommerce business model that lets retailers sell products without carrying inventory. Online sellers instead purchase items from a third party supplier or manufacturer when a customer places an order. The supplier then ships the product directly to the customer. This greatly reduces overhead costs for running an online retail business.

However, finding the right payment gateway designed to meet the unique needs of a dropshipping operation can have a big impact on long term revenue and success. This guide will explain what payment gateways are, what to look for when evaluating payment gateway solutions for a dropshipping business, as well as the top recommended payment gateways suitable for international dropshipping in 2024.

What Are Payment Gateways?

A payment gateway is a service that handles credit card processing for ecommerce transactions. Payment gateways securely transfer sensitive financial information between the customer’s bank, the payment gateway system, and the dropshipper’s bank to complete purchases.

Without a payment gateway, online businesses would not be able to collect credit and debit card payments from customers. Payment gateways authorize credit/debit card payments, ensure sufficient funds are available from the issuing bank, deposit funds into the dropshipping business’s merchant account, and provide detailed reporting on all transactions.

Many payment gateways today also provide fraud detection services and subscription management tools. Top payment gateway solutions are certified as PCI-DSS compliant to ensure secure handling of customer and payment data.

Payment Gateway Features for International Dropshipping

When evaluating payment gateways for an international dropshipping operation, some of the key features and criteria to consider include:

- Multi-currency processing – The ability to accept payments from customers worldwide in different currencies is essential for maximizing international sales.

- Global payment methods – Offering the payment types preferred across different regions like bank transfers, mobile payments, PayPal,rasonline checkouts etc. leads to higher conversion rates.

- Automated currency conversion – The payment gateway should seamlessly convert currencies to avoid extra foreign transaction fees for customers.

- Competitive international payment processing fees – Paying excessive fees on each international transaction quickly eats into profits. Finding competitive rates is vital.

- Fraud protection and risk management – Dropship orders carry higher risk of fraud and chargebacks. Using a gateway with effective fraud screening is important.

- Tax configuration for international sales – VAT, GST, and other international taxes often apply for overseas orders. Ensure tax rules can be properly configured.

- Integration support – The payment gateway should easily integrate with popular ecommerce platforms like WooCommerce and Shopify using plugins or APIs.

- Reporting & analytics – Detailed reporting on transactions and refunds should be available, ideally segmented by country, currency, and payment method.

Top Payment Gateways for Dropshipping Globally

With those key criteria in mind, below are some of the top recommended payment gateways suitable for international dropshipping businesses in 2024:

1. PayPal

PayPal is likely the most ubiquitous digital wallet and online payment processor globally. According to statistics from Oberlo on the most popular payment gateways used by ecommerce stores worldwide, PayPal dominates with an 81% market share.

PayPal supports payments from over 200 markets enabling it to handle all types of international transactions. It accepts payments in 25 currencies and withdraws can be made in 19 currencies.

PayPal also offers some of the best protection from fraudulent chargebacks and supports dynamic currency conversion. It charges a fairly competitive 2.9% + fixed fee rate for international payments outside the seller’s country.

2. Stripe

Stripe has quickly become the payment gateway of choice for many high-growth online businesses. Though it started in the US, Stripe now provides online payment processing in 44 countries.

Stripe claims to handle transactions in 135+ currencies. It charges simple flat transaction fees of 2.9% + 30¢ for international cards. Stripe also has excellent fraud detection capabilities.

Recent updates make Stripe an even more dropshipping-friendly payment gateway allowing custom order flows, enhanced reporting, improved handling of shipping delays, and other useful features.

3. 2Checkout

2Checkout is an established payment gateway provider focused on helping online merchants sell globally. It supports payments in 87 currencies with 15 language options.

2Checkout’s all-in-one monetization platform combines payment gateway capabilities, merchant account services, subscription billing management, and an optimized global checkout process.

It provides competitive mid-range pricing for cross-border transactions starting at 2.85% + 30¢ per sale. 2Checkout also has decent fraud protection and is a PayPal and Visa Trustwave validated payment processor.

4. Skrill

While lesser known in the US, Skrill is an award-winning digital wallet and payment gateway popular internationally. Owned by Paysafe, Skrill specializes in online money transfers and digital payments.

Skrill allows websites and merchants to accept over 40 currencies at a low rate of only 1.9% + fixed fee per transaction globally. It also provides buyers and sellers Pay-After Delivery options to reduce risk on high-value orders.

This makes Skrill an affordable high-risk payment processing option. Skrill has mobile payment capabilities allowing customers to easily complete purchases using just their phone.

5. Payoneer

Payoneer takes a different approach from traditional payment gateways, instead focusing solely on facilitating cross-border B2B payments.

While Payoneer cannot integrate directly with a dropshipping store’s shopping cart, it can facilitate receiving customer payments from over 200 countries into a local bank account cheaply. Funds held in a seller’s Payoneer account can also pay international and domestic suppliers.

Payoneer charges transparent, competitive fees starting at just $3 per seller payment receipt, capped at 1% annually. It’s an easy way for dropshipping merchants to centralize global payment operations.

6. Shopify Payments

Shopify Payments is the built-in payment gateway solution integrated directly with all Shopify stores. It offers convenience, allows online sellers to skip setting up a traditional merchant account, and enables collecting payments directly into a Shopify account.

According to Shopify, its payment gateway currently supports over 100 currencies and previously required a third-party provider to accept international payments. Shopify Payments facilitates sales from buyers worldwide.

Transaction fees consist of 2.9% + 30¢ which is in-line with most other popular payment gateways. Certain large Shopify subscription plans can qualify merchants for reduced transaction rates.

For many Shopify dropshipping stores, especially new businesses, Shopify Payments presents an easy option to get up and running quickly without needing to setup an outside payment gateway initially.

Choosing the Right Global Payment Gateway

Finding the payment gateway that best aligns with a dropshipping operation’s specific business needs and markets is key. Assessing factors like target countries, currencies, pricing, tools, and risk management capabilities helps select the optimal solution.

Most global payment gateways like PayPal also provide sandbox testing modes enabling merchants to safely test payments before going live. This allows dropshippers to validate integrations and functionality.

The ability to securely accept online payments from all corners of the map puts growth opportunities well within reach for internationally ambitious dropshipping merchants. Removing friction in the global payment process helps customers complete purchases anywhere through preferred local payment methods.

By implementing the right international payment gateway, dropshipping businesses can feel confident in seamlessly scaling overseas without borders holding them back. The providers profiled here have helped countless merchants expand globally. Leveraging their capabilities can become a competitive advantage for forward-thinking international dropshipping operations during 2024 and beyond.